PRO MUJER

Unlocking financial independence for Indigenous women entrepreneurs

WHAT?

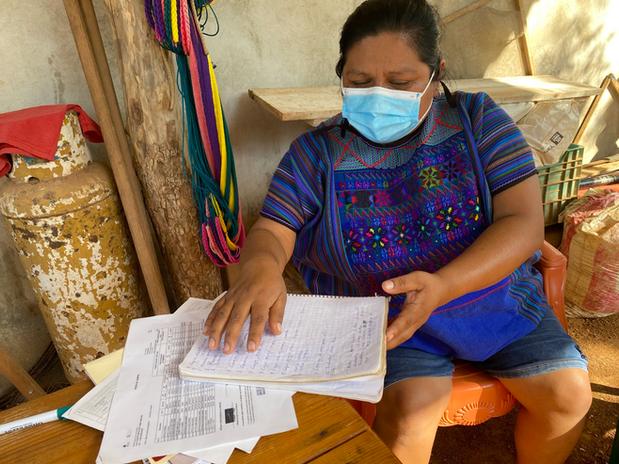

Dalberg partnered with Pro Mujer and the Kellogg Foundation to conduct a foundational study on the financial and entrepreneurial lives of rural and Indigenous women in Chiapas and Yucatán. The research was designed to inform Pro Mujer’s expansion into Mexico’s southeast by grounding service design in women’s lived experiences.

WHY?

Rural and Indigenous women in southeast Mexico are active entrepreneurs, yet face entrenched barriers like, limited access to credit, low digital and financial literacy, and exclusion from formal markets. Pro Mujer aimed to better understand their needs, aspirations, and challenges in order to tailor products and services that foster economic independence and sustainable entrepreneurship.

OUTCOME

The research shaped Pro Mujer’s strategic expansion roadmap by identifying where and how to best serve over 10,000 rural and Indigenous women entrepreneurs in southeast Mexico. The project produced a rich foundation of insight-driven deliverables, including detailed state profiles, ecosystem maps, user archetypes, and service design recommendations.

These outputs highlighted both the diversity and commonality of women’s experiences across Chiapas, Yucatán, and neighboring states, revealing clear opportunities for Pro Mujer to offer tailored financial and non-financial products, strengthen trust-based delivery channels, and improve the customer experience across the full journey of women entrepreneurs.

DURATION

3 Months, 2022

LOCATION

Mexico

MY ROLE

Project Lead

Led and conducted Design Research

Led and conducted synthesis and storytelling

TEAM

Fabiola Salman

Marcos Paya

Evelyn Garrido

Carlos del Rio

Scott Faucci

LINKS

HOW?

The study was built on two pillars:

1. Quantitative analysis of socioeconomic and inclusion indicators across Campeche, Chiapas, Oaxaca, Tabasco, and Yucatán using national datasets (e.g., ENIF, INEGI, CONEVAL).

2. In-depth qualitative research with 50 women entrepreneurs across Chiapas and Yucatán. Using Human-Centered Design tools—including journey maps, financial life mapping, seasonal cycles, digital tool cards, and decision scenarios—we explored women’s household finances, business realities, and future goals. We also interviewed local financial institutions, capacity providers, market access actors, and government agencies to map the existing ecosystem and service gaps.

This work laid the groundwork for a pilot program focused on building sustainable livelihoods, strengthening women’s economic agency, and connecting underserved entrepreneurs to the broader financial ecosystem in southeast Mexico.